Wednesday, December 12, 2007

RDC Continues Meteoric Growth

Alliance Bank: VP/ Director of Information Technology

Allstate Insurance Company: Associate Consultant

American National Property & Casualty Co.: Sr Premium Payment Specialist

AmeriGas Propane: Director of Revenue Mangement

Ameriprise Financial INC: Director Document & Payment Operations

Blue Cross Blue Shield of Alabama Manager-Cash Management & Investments

Blue Cross Blue Shield of Alabama Operations Manager-Payment Processing

Capital One Auto Finance Payment Processing Sr. Unit Manager

CenterPoint Energy Director of Remittance

Christian Broadcasting Network, Inc. Manager-Remittance Processing

CNH Capital America LLC Mgr, Cash Processing and Processing Svs

County of Orange Cash Manager

Customs & Border Protection Office of Training and Development

Department of Defense Senior Technical Advisor

Department of Homeland Security Chief Knowledge Officer

Duke Power Company Collect Process Design Specialist

Eastern Bank AVP

Father Flanagan's Boys Home Lockbox Manager

Fifth Third Processing Solutions Vice President - Relationship Management

First American Real Estate Tax Svs Director of Operations

Florida Power & Light Company Customer Billing Supervisor

FOOTSTAR AP MANAGER

Illinois National Bank Vice President

Indiana Department of Revenue Administrator of the Returns Processing

JPMorgan Chase & Company Executive Director, Receivables Product Mgt.

Library of Congress Acting Chief

LifeWay Christian Resources Manager of Accounts Payable

M & I Bank Vice President

Maryland Health Care Commission Division Chief - Center for Health IT

Media General, Inc. Remittance Processing Manager

Morgan Stanley Executive Director

Navy Federal Credit Union Manager, Remittance Processing

New Jersey Department of Banking and Insurance State Coordinator

New York City Department of Education Technology Instructor

North American Membership Group, Inc. Operations Manager

Northwestern Mutual Director, Shared Services

Nuclear Regulatory Commission

Office of Tax & Revenue Branch Chief Receipt & Archive Branch

Office of the General Counsel Director of Litigation

Orange County Treasurer-Tax Collector Chief Assistant Treasurer-Tax Collector

Palmetto GBA Director

Pediatric Associates of Richmond Information Technology Specialist

Pepco Holdings, Inc. Business Systems Project Manager

PNC Bank Vice President, Sr.Product Manager

Portland General Electric Company Manager - Revenue Collection

PSE&G District Manager - Customer Operations

Richland County Information Technology Business Systems Division ManagerSkechers USA ACCOUNTS PAYABLE MANAGERSOURCECORP BPS Inc Director of OperationsState Farm Insurance Company Systems AnalystSunlife Financial Sr Manager, Imaging CenterT.Rowe Price Services, Inc Assistant Vice PresidentThe Huntington National Bank Product Manager-SeniorTime Warner cable Regional AP ManagerU.S. Cellular, Inc. Mgr, Accounts Payable/Business Support ServicesU.S. Department of State ComplianceUMUC Program Director, Telecommunications ManagementUnion Bank of California Vice President/ManagerUnited States Treasury Assistant Commissioner Federal FinanceUnited Water VP of Customer ServiceUnity Health Insurance Systems AnalystUS Attorney's Office Information Technology SpecialistVerizon Communications ManagerWells Fargo Bank Product Manager

Tuesday, December 11, 2007

Optical Reader Inventor Dies

David H. Shepard, inventor of the optical reader, has died at the age of 84.

The following obituary, written by Douglas Martin, appears in today's New York Times.

David H. Shepard, who in his attic invented one of the first machines that could read, and then, to facilitate its interpreting of credit-card receipts, came up with the near-rectilinear font still used for the cards’ numbers, died on Nov. 24 in San Diego. He was 84.

The cause was bronchiectasis, a disease of the bronchial tubes, his wife, Joyce, said. Mr. Shepard followed his reading machine, more formally known as an optical-character-recognition device, with one that could listen and talk. It could answer only “yes” or “no,” but each answer led to a deeper level of complexity. A later version could simultaneously handle multiple telephone inquiries.

He formed and led companies to profit from his inventions. His Intelligent Machines Research Corporation developed and sold the first dozen optical-character-recognition systems to companies like AT&T, First National City Bank, Reader’s Digest and most major oil companies. Mr. Shepard sketched out the familiar boxy numbers on credit cards, called the Farrington B numeric font, on a cocktail napkin at the Waldorf-Astoria Hotel, his wife said. The shapes were meant to be as simple and open as possible because gasoline station pump islands were among the earliest places optical character recognition was used; the shapes were meant to minimize the effects of smearing with grease, oil and other substances.

The font — with a 7 that looks like two sides of a rectangle — has persisted even as the numbers have faded from use: the magnetic strip on the cards’ back now carries the necessary information.

Mr. Shepard was in the Army in World War II, helping to break the Japanese code. He then worked on other codes for the Armed Forces Security Agency, the precursor to the National Security Agency. He reasoned that it must be possible to build a machine to read coded messages.

So he and a mechanically inclined colleague, Harvey Cook Jr., went up to the attic of Mr. Shepard’s home in Arlington, Va. They spent a year and $4,000 and came down with what they called Gismo, a machine that could recognize 23 letters of the alphabet as produced by a standard typewriter. After another year’s work and more investment, they had developed a machine that could recognize all 26 characters.

Mr. Shepard filed for the patent under his own name; started his company, Intelligent Machines; and moved operations to a small store in an Arlington shopping mall. IBM agreed to license the machine, formally named Scandex, for a 5 percent royalty.

IBM held back on manufacturing the machine but paid advance royalties, which Mr. Shepard used to make what is widely believed to be the first character-sensing machine to be sold. It was bought by the Farrington Manufacturing Company, a pioneer in the credit-identification field.

Farrington became Mr. Shepard’s best customer, and he sold his own company to Farrington. The deal made Intelligent Machines a subsidiary of Farrington and made Mr. Shepard Farrington’s largest shareholder.

Mr. Shepard left Farrington in 1961, and the next year started another company, the Cognitronics Corporation. In 1964, his “conversation machine” became the first commercial device to give telephone callers access to computer data by means of their own voices. At Cognitronics, he also developed a more accurate method of optical character recognition using lasers.

Mr. Shepard apologized many times for his major role in forcing people to converse with a machine instead of with a human being.

Thursday, November 29, 2007

How efficient are your Account Payable operations? Register for a Free Webinar December 11th 11am EST.

Invoice receipt

Document image and data capture

PO matching

GL coding

Online approvals with full audit trail

Booking in ERP system

Content storage/archiving

Workflow management

Posting

Supplier portal

Indirect purchasing

Customized reports

Queries and analyses

Bridging the Workflow Gaps in Healthcare

Addressing business and technology pressures

By Margaret Mayer

Boston Software Systems

From TODAY Magazine Archives www.tawpi.org

At the turn of the last century we finally realized the pundits were right: “all business is e-business.” The rise in use and popularity of electronic transactions has fueled an expectation of faster more accurate service from every business sector, including healthcare. Fulfilling the technology expectations of patients, government, physicians and financial managers becomes a matter of bridging a

multitude of gaps between the data sources that exist behind a transaction or information request. As in life science, where evolving species are most successful

when they are adaptable, those business organizations willing to adapt to new approaches, technologies and solutions will ultimately thrive. The pressures of particular business drivers within healthcare are creating opportunities for organizations to evolve or reinvent processes and workflows through the adoption of technologies that respond to these drivers.

While the goals of each organization define specific mandates,

major business drivers within healthcare can be grouped into three

main categories:

• Regulatory Issues (HIPAA, patient safety initiatives, interoperability

requirements)

• Technology Demands (new clinical applications, EHR, CPOE)

• Business Issues (faster revenue cycle, reduced FTEs,

Internet/portal connectivity)

The race to handle these pressures effectively requires a careful analysis of existing workflows and processes, as well as an evaluation of how technology is best used in a particular organization. Ultimately, how efficiently an organization can move data and share information determines how well it fills both the information and the process gaps that these business drivers create. The passage of the Health Insurance Portability and Accountability Act (HIPAA) has been the impetus to improve record keeping and has forced organizations to use technology to ensure compliance.

As deadlines approach for the various components of HIPAA, hospitals assume greater responsibility for managing the manual processes still in place and the associated reporting required by HIPAA. While HIPAA has been a great motivator in building a technical infrastructure within hospitals, HIPAA requirements in and of themselves are not revenue-producing activities and do not offer the financial return that enables organizations to hire staff dedicated to compliance.

Understanding Workflow and Tasks

The bottom line is that healthcare organizations will have to evaluate

how the tasks and processes that impact the basic operation of

the organization are completed. The complexity of information gaps in healthcare seems to strangle attempts to automate processes and fill these gaps. Because of the

way healthcare organizations have evolved, individual departments, clinics and physician practices have developed unique workflows to handle information within their specific departments or systems. These workflows are often developed in response to an immediate demand without consideration for how the information is ultimately used or how the process might be automated. These types of paper

or manual workflows may accomplish the initial goal of getting specific

information from one desk to the next, but they lack efficiency and

accuracy.

Every organization has processes or workflows already in place to

manage their business at any particular point. However, the proliferation

of small manual tasks abounds in the hospital environment,

creating points of failure for more strategic information strategies.

For instance, a fully functioning Computerized Physician Order Entry

(CPOE) system must integrate with:

• Clinical data repository

• Nursing and physician (and other caregiver) documentation

systems

• Clinical decision support system

• Results reporting system

• Electronic medication administration system

• Pharmacy system

That’s at least six informational gaps which need to be filled, and

within each area, manual tasks that may create points of inaccuracy.

As the demand for CPOE rises, the demand to fill those gaps and

automate tasks intensifies.

Filling Tactical Gaps to Automate Manual Processes

In healthcare, improving business processes may begin by evaluating

areas where paper-driven processes are slowing down workflow, contributing to inaccurate data use, and ultimately, to lost or delayed revenue. One hospital filled this task gap using powerful scripting software. Mount Auburn Hospital in Cambridge, MA. found that attaching accurate patient information to specimens going from clinics and physician offices to the hospital was a problem. In some cases, only handwritten patient information was accompanying a specimen to the hospital lab, creating many inaccuracies including wrong insurance, a wrong address or simply illegible writing. Lab personnel had to take valuable time to register patients using this information, which delayed the ordering of lab work. This ultimately caused billing delays, costly corrections and re-billing issues. The scripted solution allows Mount Auburn Hospital to realize faster turnaround in billing with fewer corrections. Lab work is expedited because personnel aren’t manually performing registrations.

The script works like this: When a sample is drawn, the physician’s office sends patient information to a text file in its IDX physician system. The script runs continuously Monday through Friday, from 8:00 a.m. through 6:00 p.m., automatically logging in and checking for new patient files to be registered. When it finds one, it automatically registers the patient into the hospital’s MEDITECH Magic system and produces an audit file detailing the number of records processed and any exceptions that were encountered. In addition, the script formats and sorts an Excel spreadsheet that details all of the actual data sent from the physician’s office. Both files are produced daily, are date stamped and the actual data is backed up. At the end of the day, a copy of the exception report and the Excel spreadsheet are e-mailed to a distribution list for review.

The Value of Automation

Automating specific tasks yields fast returns on investment. Reinventing whole processes, yields beneficial and predictable outcomes with payoffs that are both tangible and intangible. The mandate to make significant changes in hospital processes may come from one of the business drivers described above, but instituting those changes begins with a clear vision of corporate goals and buy-in from the administration and the business users. Ensuring that the

end product of process development lines up with the corporate

vision helps keep the process in focus and the staff fully committed

to its success.

When Credit Valley Hospital in Mississauga, Ontario moved to automate its registration process, they started at the top with the corporate vision and goals. They evaluated areas that would offer the greatest benefit and developed an Information Management Plan that focused on specific areas within the hospital that could benefit from process improvement. There were a number of reasons why Credit Valley chose to reinvent its registration process. With more than 40 registration areas (six areas off-site) and 163 registration users, it was difficult to monitor the accuracy or consistency of captured data. Inaccurate data capture

leads to lost revenue, incorrect patient demographics, inaccurate abstract data sent to the Canadian Institute for Health Information (providing part of the basis for hospital and facility planning and funding, disease surveillance, public health expenditures, physician

referral patterns and other community based services), incorrect contact information (needed for effective disease surveillance) and the inability to standardize for addresses, postal codes and residence codes.

Credit Valley’s IT department had two primary goals: standardize the way patients were registered and improve the quality of data being captured at the point of entry. This would create a proactive, rather than reactive, approach to information gathering. The hospital

began by working with the registration clerks to develop a Project Definition which identified all the fields on registration screens that were misused, misinterpreted or simply ignored. To enforce standardization, they established business rules which monitor users to ensure that no field is improperly filled or ignored. To ensure data quality and recover revenue, the hospital integrated an address validation product into the registration process, providing automated address look-ups. Since completing this project, Credit Valley has experienced an 80% drop in address inaccuracies that slow revenue recovery. They admit that any process enhancement, including this one, requires constant improvement and upgrades, but the financial and strategic rewards are well worth the work.

Developing On-Demand Processes

By closing the information gaps that exist throughout the hospital

environment, organizations reap fast financial rewards. Even the

automation of common manual tasks – such as re-keying data or downloading reports – allows for the reallocation of resources, substantial time savings and may save significant third-party vendor costs. Powerful task automation tools are available that allow hospitals to reinvent or realign processes on an as-needed basis to

develop the workflow that meets the expertise of their end users and supports their overall technology environment. Developing an environment for continuous, on-demand process innovation and workflow automation allows organizations to respond

not only to tactical needs, but also to strategic business requirements.

It bridges the information gaps in healthcare and lays the

foundation future technology demands.

Wednesday, November 28, 2007

Taking Some of the Pain Out of Lockbox Conversions

To be sure, transitioning to a lockbox provider from an in-house payments processing environment can be a stressful process with lots of hurdles along the way. But taking time early on in the process to evaluate your legacy systems and true business requirements can keep your conversion from getting tripped up, says Craig Bjork (cbjork@cds-global.com), director, account and business development, Data Capture Services, for CDS Global, a subsidiary of The Hearst Corporation. Bjork provided me with the following tips for corporate billers looking to streamline the conversion to a lockbox provider:

… Evaluate your billing systems capabilities. “A good lockbox provider will want to limit the number of exceptions clients receive by working through all of the transactions a client’s billing system can handle,” Bjork said. “This goes beyond payments to things like change of address requests and requests for information. Knowing what your billing system can handle means you can offload this work to the lockbox provider, freeing your internal staff.”

… Clearly define business rules and expectations, early on. “Moving to a lockbox provider is a good time to evaluate business processes and the value they provide,” Bjork said.

… Don’t get too hung up on the mechanics of how your lockbox provider will process your work (the models of machines, version of software, etc.). The corporate biller’s primary concern should be whether the work is getting done correctly and on time, Bjork explains. In this vein, also be sure to regularly monitor the work being done on your behalf: ask for measurements and appropriate reports (be sure to read them!), and make periodic visits.

… Outline critical times for file and information delivery. But make sure that these times correspond to key deadlines, such as billing cut-offs or customer service postings. Don’t set delivery times solely based on convenience or the way things have been done in the past.

… Assign one individual on your transition team to handle communications and deliverables handoffs. While your transition team should include a cross-section of project stakeholders, having a single point of contact helps ensure timely and accurate project status updates.

… Trust your selected service provider, and let go. “This is why it’s so important that you choose a lockbox provider that is as concerned about your customers as you are,” he said.

Any strategies that your organization found useful? E-mail me at m_brousseau@msn.com.

Monday, November 26, 2007

The Skinny On Trade Shows

Many vendors wonder about the true costs of exhibiting at trade shows. Now, Exhibit Surveys Inc.'s 2006 Trade Show Trends Report provides some answers. According to the study, exhibitors spend an average of $126 per attendee that enters their exhibit and expresses an interest in their products and/or services. Moreover, exhibitors spend an average of $236 per attendee that engages in conversation with a staff member. How does this compare to your company's exhibit costs? E-mail me at m_brousseau@msn.com.

Friday, November 16, 2007

Remote Channels Drive Growth

U.S. bank transactions are expected to grow at a compound annual rate (CAGR) of nearly 10 percent between 2006 and 2010, according to Needham, MA-based TowerGroup. Driving this growth are remote channels, with the fastest rates coming from online (27 percent) and the call center (7.1 percent), followed by the branch (still kicking at 1.4 percent) and the ATM (0.5 percent).

Is this what your bank is projecting? E-mail me at m_brousseau@msn.com.

Online Bill Payment Pays Off

For financial institutions, integrating online banking and bill payment has the potential to reduce operating costs, expand cross-selling and up-selling capabilities, and increase consumers' interactions through the online channel, according to CheckFree Corp.

Online banking customers visit their financial institutions' sites an average of 11.2 times per month, according to the 2007 Consumer Bill Payment Survey, conducted by Harris Interactive with the Marketing Workshop, and sponsored by CheckFree. However, customers who use both online banking and bill payment services visit their financial institutions' sites 13.4 times and those who use electronic bills to receive and pay their bills visit the online banking sites an average of 15.1 times, according to the same survey.

Today, online banking and bill payment exist as separate applications on many financial institution websites -- meaning banks have a ready opportunity to improve their bottom line.

What do you think? E-mail me at m_brousseau@msn.com.

Monday, November 12, 2007

The Secret to RDC Adoption

Ease of enrollment (implementation and training) is the key to the mass adoption of remote deposit capture, Jane Darga, vice president, product development, at Comerica said during a presentation at TAWPI's Payments Automation: Beyond Capture & Clearing Conference last week in St. Petersburg, FL. What do you think? E-mail me at m_brousseau@msn.com.

Sunday, November 11, 2007

Shifting Online Behaviors

In a keynote presentation entitled "Thinking Beyond Tomorrow" at TAWPI's Payments Automation: Beyond Capture & Clearing Conference last week in Florida, Sanjiv Sanghvi, president and CEO of Wells Fargo HSBC Trade Bank, noted that megatrends such as electronic payments are accelerating, and provided several examples of shifting online behaviors and interests:

- 158 billion text messages were sent in 2006

- 8.4 percent of U.S. households are wireless-only

- 74 percent of single Internet users in the U.S. have taken part in at least one online dating-related activity

- More than 100,000 marriages a year result from people meeting on an online dating service

- 10 percent of cell phone users age 18 to 34 have "texted" someone out of their romantic lives

- MySpace is second only to Yahoo! in the U.S. market in terms of page views

Against this backdrop, Sanghvi told the audience that in order for financial services providers to survive in the emerging electronic payments environment (where more payment choices are coming), they must listen to their customers, and keep new product offerings simple ("adopt then adapt"). He also advised financial services providers to remember that technology is the enabler, not the end state (just like financial services). What do you think? E-mail me at m_brousseau@msn.com.

Saturday, November 10, 2007

Industry Collaboration Critical For Survival

Increased industry collaboration will be needed in the future in order for financial services providers to deliver more value to their corporate clients, J.D. "Denny" Carreker, vice chairman, strategic payments initiatives at CheckFree Corporation said during a luncheon presentation this week at TAWPI's Payments Automation: Beyond Capture & Clearing Conference in St. Petersburg, FL. "Some progress is being made, but more is needed to drive costs down and bring additional value," Carreker told the audience.

Driving a more integrated, streamlined payments industry will benefit everyone in the new payments environment, Carreker said. These benefits include:

- Reduced costs

- Reduced risk

- Reduced float

- Improved funds availability

- Increased access to, and faster delivery of, consolidated payment information

- Faster, more efficient delivery of new payment-related services

What do you think? E-mail me at m_brousseau@msn.com.

Management Buy-In Key To Outsourcing

Whether your organization is a financial institution or a corporate biller, one of the most important things you must do when looking at outsourcing lockbox processing is to get senior management to buy into the process early-on, Serena Smith, senior vice president at Fidelity National Information Services said during a presentation this week at TAWPI's Payments Automation: Beyond Capture & Clearing Conference in St. Petersburg, FL.

"What's also important to know is whether senior management is looking for a vendor or a partner," Smith told the audience. "The service provider needs to know what a customer's plans are five years down the road, to help us with our planning."

Smith's co-presenter, John Mintzer, vice president at Citizens Bank, said companies outsourcing their lockbox operations must be committed to following a formal project methodology all the way through the process. "If you don't follow a project methodology, you will be 'committed' at the end," Mintzer joked. What do you think? E-mail me at m_brousseau@msn.com.

Friday, November 9, 2007

Capture Conference-Imaging to Archive-December 6th to 7th

This is a must attend event for end-users looking strategically at the future of document capture, workflow, back end integration and improving your own image based operation. Whether your company is looking to automate and improve upon your invoice processing or scanning of EOB's, claims, forms, the TAWPI Capture Conference at the Doral Resort December 6th to 7th will be the place to be. Click Here to register.

Partial Conference Agenda:Solutions Overview

Ralph Gammon, Editor, Document Imaging Report

Join us for breakfast and hear a brief overview detailing what products you’ll find in the vendor showcase.

Keynote Address: “The Future of Document Imaging”

Dolores Kruchten, General Manager, Document Imaging, Vice President, Eastman Kodak

Keynote Address: How Intelligent Capture & Exchange Solutions Can Effect Positive Organizational Change and Automate Business Processes Andrew Pery, Vice President of Marketing, Kofax

Strategies for Outsourcing Document Processing

Jan Trevalyan, President, Direct Data Capture;

Bob Zagami, General Manager, DataBank IMX;

Devang Thakkar, Senior Product Manager, Enterprise Information Capture Solutions, Anacomp

Case Study: Montgomery County Increases Efficiency and Accuracy with Forms Processing

Dieter Klinger, Enterprise Services Division Chief - Department of Technology Services, Montgomery County

Craig Laue, Eastern Regional Manager, ABBYY USA Software, Inc.

Trends in Invoice Processing

Ralph Gammon, Editor, Document Imaging Report

Case Study: Beyond Claim Processing at Blue Cross Blue Shield of North Carolina

Jay Keogh, IBML

Christina Lane, Operations Manager, Blue Cross Blue Shield of North Carolina

NEW Success Stories in Enterprise Content Management Bill Premier, Chief Operating Officer, Hyland Software

Unstructured Document Processing Panel Discussion

John Craig, Account Manager, ReadSoft North America

Ken Kriz, Product Manager, AnyDoc Software

Jerry Metcalfe, Sr. Director, Captaris

Andy Lawrence, Product Manager, Eastman Kodak

Monday, November 5, 2007

From Transaction Systems To Analytics

In an article on trends in IT capabilities and advancements in healthcare finance that appears in this month’s issue of HFMA’s magazine, Deb Davis and Jim Adams, both of IBM Global Business Services, identified the move from transaction systems to analytics.

“As advanced clinical systems are implemented, the value of clinical information can be extended beyond the transaction level to be used for risk management, trend analysis, and analytics that include financial and clinical data,” Davis and Adams wrote.

The development of a health analytics roadmap can determine strategic priorities in the analysis and use of data with research, finance, and patient care, they conclude.

Sounds like another example of the convergence of payments and document processing to me. What do you think? E-mail me at m_brousseau@msn.com.

Monday, October 15, 2007

Efficiency Key To Corporate Treasury

For those of you still wondering about the industry’s move from traditional remittance processing to receivables management (which integrates transaction processing more tightly with accounting functions), a recent survey by Business Finance and JPMorgan Chase should give you pause.

Internal efficiency initiatives were cited by three-quarters of respondents as the most important driver of the corporate treasury function – ahead of the economy, mergers and acquisitions, globalization, and financial industry consolidation. Maybe there’s something to the push for A/R matching, auto-posting and invoice scanning after all.

What do you think? E-mail me at m_brousseau@msn.com.

Get Ready For More RP Vendor Consolidation

You might have been surprised to hear this morning that long-time remittance and lockbox solutions vendor JB Software, Inc. is being acquired by India-based 3 i Infotech Ltd.

3 i Infotech signed a deal to acquire the TAWPI Hall of Fame member and its units for $25.25 million in cash, according to a Dow Jones report. The move will give the Indian company a greater footprint in the payments processing business in the U.S.

“This company has a payments processing product which is well accepted in the U.S. market. We expect strong growth for this product in markets outside the U.S. as well,” 3 i Chief Financial Officer Amar Chintopanth told the Dow Jones Newswires.

While Chintopanth might be expecting growth for JB Software, several industry watchers I spoke with today are anticipating more consolidation among remittance solutions vendors. “I expect to see continued consolidation among the remittance solutions providers, fueled by the growth opportunities offered by remote deposit,” Creditron President Wally Vogel (wally_vogel@creditron.com) told me, noting that JB Software was only an occasion competitor to Creditron, which was acquired this summer.

“Remote deposit, integrated with the accounting functions of remittance processing, provides a powerful tool with business implications for accounting application providers, banks, large corporations and remittance technology companies,” Vogel said. “There is an intersection of opportunities for these diverse players that makes this an exciting time for our market.”

Steve McNair (mcnairs1@aol.com), president of FTP Consulting Services, Inc., in Southlake, TX, also expects more consolidation among remittance solutions providers. Going forward, he believes we could see more end-user interest in payments outsourcing than in remittance software license sales.

“This deal is significant because it’s further evidence of the consolidation of the remittance market,” McNair told me. “What’s also interesting is that the deal is with an international company with little background in remittance processing. Given that, I’m wondering whether JB Software will be changing focus towards global engagements, and specialized processing efforts, such as government and custom applications.”

To that end, McNair said 3 i Infotech, by virtue of being based in India, could likely provide JB with the people necessary to deliver on custom programming efforts.

Clint Shank (cshank@sortlogic.com), president of Omni-Soft, Inc., the parent company of SortLogic SYSTEMS, sees this deal as part of a worrisome larger trend. “In my view, our market is eating itself from the inside out. The big sales based on big hardware and expensive software are gone, and in their place is a commodities market,” he said. "The folks that did well in the past are falling flat in this market. For instance, how long was IBM the most dominant player in our market? Forty years? Fifty years? What does it mean now that they aren’t even present? Look at BancTec and you see pretty much the same thing.”

“What we are experiencing is a real sea change,” Shank continued. “The big players are too slow to respond to an overnight shift in the market and the new guys are filling the void. It used to be that the big ate the small. Now it’s the quick that eat the slow.”

The question everyone I spoke with was asking was: “Who is the next to be eaten?”

What do you think? E-mail me at m_brousseau@msn.com.

Friday, October 12, 2007

Non-Profits Up The Ante

Go to any conference of charitable organizations, and the conversation will almost inevitably turn to fundraising, and how to effectively steward donors so they’ll be more likely to donate more frequently, and in larger amounts. The solution, many non-profits are discovering, is to better leverage their back-office – or their caging or cashiering operation, as many non-profits call it – to capture more timely, higher-quality information from incoming donations. Non-profits can then use this information to better target and personalize their appeals.

And this is good news for some lockbox providers, says Lesa Brooks, general manager, Data Capture Services, West Region, for CDS Global (lbrooks@cdsfulfillment.com). This evolution of traditional donations processing (open mail, deposit check, send supplemental remittance documents on to someone else for handling …) plays right into the industry’s integration of advanced data capture and recognition (think: medical payments/EOBs).

“Non-profits are asking for image and data capture of any document that may be sent to a lockbox. This obviously includes the check, but also appeals, special requests, membership forms, magazine subscriptions, correspondence, directions for how the donation should be used, and more” Brooks told me. “With this information, non-profits hope to accelerate donations posting, eliminate keying of donor information, and feed their analysis and donor management systems. They also want to speed the generation and personalization of their ‘thank you’ letters, which are key to convincing people to donate to the non-profit again.”

Brooks warns that this version of donations processing is not for everyone: “It is specialty processing – certainly not vanilla – and most non-profits require and demand very personal attention.” It’s for these reasons that many bank lockbox providers are not overly excited about processing donations. “The sheer number of forms scares many banks off,” she said.

But Brooks sees that as an opportunity for her company, and others like it.

Thursday, October 11, 2007

Get Off The Paper Trail

The mortgage industry is inundated with paper: original signed applications, title forms, personal identification, appraisals, and more. Managing all of these documents through the traditional steps of organizing, photocopying, faxing and filing is costly, inefficient and unnecessary. That’s according to eGistics Vice President David Whitehead (dwhitehead@egisticsinc.com).

“Lenders would be much more productive if they didn’t have to spend so much time shuffling papers, searching for loan files on someone’s desk, or carrying paper from one department to another,” Whitehead told me. Statistically speaking, industry studies show that employees spend an hour-and-a-half to two hours per day shuffling papers. Whitehead noted that, “Reducing this paper handling time by a half hour or more could have a significant impact on a lender’s bottom line. Lenders can become more productive, service their customers better, and save big money.”

Whitehead said there are four steps to getting off the paper trail:

1. Capture documents immediately at the point of entry

2. Capture any kind of documentation

3. Capture these documents without having to manually index

4. Make the documents immediately available in electronic format throughout the organization

Whitehead warns that Step 4 is critical.

“Most of the useful work on a mortgage document is done within the 48 hours of its life,” Whitehead said. “So an organization has to ensure that their mortgage document aren’t just imaged, but available to be extracted in a way that is straightforward and intuitive for users. Otherwise, the siloing of information adds to the challenges of effectively managing the overall customer relationship.”

Once they get off the paper trail and move to electronic document management, Whitehead said lenders can achieve lower operating costs, greater collaboration, reduced cycle times, improved customer service, and better support for governance, risk and compliance initiatives.

Has your lending organization implemented electronic document management? E-mail me at m_brousseau@msn.com.

Check 21 Speed Bumps

With the banking industry seemingly speeding towards electronic check clearing, it’s easy to forget that there are some speed bumps along the way. I asked Clint Shank (cshank@sortlogic.com), president of Omni-Soft, Inc., the parent company of SortLogic SYSTEMS, what he saw as the biggest obstacles that financial institutions are facing as they migrate to electronic clearing. His response: the fact that paper checks are still being issued, and that most legacy capture systems won’t get replaced anytime soon.

Shank noted that most businesses – and some individuals – would continue to issue paper checks for the foreseeable future, a fact that is backed up by myriad studies. And while printing substitute checks or image replacement documents (IRDs) to process in-clearings is not cost prohibitive, it’s also not cheap. Similarly, Shank believes that most legacy check capture systems still have substantial value on the books, and many financial institutions have a big investment in staff focused on using and maintaining these systems.

“The replacement cost for a system that handles both paper and electronic payments is steep, in terms of dollars, resources and time,” Shank noted. “The cost to upgrade a legacy system to process electronic payments may be more affordable, but nonetheless, is still pretty pricey. Moreover, with the consolidation in the solutions provider market, it is now possible for the unwary to put money in their competitor’s pocket by investing in an upgrade to an existing legacy system,” Shank added.

So Shank believes the real hurtle that financial institutions must overcome is how to protect their investment in their legacy capture system, while still moving toward check truncation. “This is a game played on a knife’s edge, where any miss-step can provide costly,” he said. “Perhaps this is why new services like remote deposit capture and Back Office Capture – which can be added without compromising this delicate balancing act – are so highly favored.”

How are your financial institution’s legacy systems impacting its electronic clearing initiatives? E-mail me at m_brousseau@msn.com.

Wednesday, October 10, 2007

Utilities Eyeing Payments Outsourcing

Declining check volumes and rising paper-check clearing costs are forcing more utilities to look toward third-party lockbox providers and banks for outsourced payments processing solutions. That’s according to Serena Smith, senior vice president, Remittance Processing Division, for Fidelity National Information Services (serena.smith@fnis.com).

Smith told me that the story isn’t much different in the other industries with which Fidelity National Information Services works. But utilities are finding that they need to consider outsourcing to reduce operations costs and update outdated processes and technology.

“Many of the larger utilities that we are courting are not taking advantage of an online archive, ARC, or automated exceptions modules,” Smith said. “Status quo seems to have been the case in the utility industry for many years, and partnering with a different technology vendor – if in-house – or services provider – if outsourced – is helping utilities leverage new technologies and achieve even greater efficiencies.”

The industry’s move towards electronic payments is another factor driving utilities to consider outsourcing. Smith noted that many utilities are struggling with how to effectively manage their various payments channels (including Web store fronts), and they often have standalone systems and processes for each channel. Outsourcing allows utilities to largely offload this responsibility and dramatically consolidate their systems and processes.

The bottom line: “Many utilities have a desire to remain in-house. But the increased cost of processing will force others to take a stronger look at outsourcing – something that would never have been an option for some of these organizations several years ago,” Smith said.

Has your utility changed its thinking on payments processing outsourcing? E-mail me at m_brousseau@msn.com.

Tuesday, October 9, 2007

Accounting Technology Is Adequate ... Or Not

In a survey of finance leaders by Treasury & Risk magazine and Citigroup, a staggering 74 percent of respondents say accounting is the top function that is well supported by technology. Cash flow forecasting (33 percent), custody/trust (23 percent), foreign exchange (20 percent) and account reconciliation (19 percent) bring up the rear, albeit many lengths behind.

But before you accounting solutions providers get too full of yourself, it’s important to note that, in response to a separate survey question, finance leaders also pegged accounting as the top function that needs to be supported more effectively by technology (52 percent). Following close behind was business performance management at 51 percent. Other functions where finance leaders think technology could be doing a better job: cash flow forecasting (43 percent), compliance (37 percent; executives told the survey that they spend the most time on control and compliance) and account reconciliation (29 percent). The complete survey results can be found online at http://www.treasuryandrisk.com/.

How has your organization used technology to more effectively support accounting? E-mail me at m_brousseau@msn.com.

Sunday, October 7, 2007

Benchmarking Blues

By Mark Brousseau

In a column in the October 15th issue of FORBES, Publisher Rich Karlgaard notes that a flaw common to business and rampant in government is the failure to benchmark. In sports, performance and relative performance are laid bare for anyone to see. But in business, the instincts are to shut our eyes to benchmarking, Karlgaard wrote. “We don’t want to see,” he claimed. Karlgaard’s recommendation is to start the benchmarking process with three questions:

... What does our competition do better than we do?

... Are our shortcomings rooted in our personnel, our system or something else?

... Which companies that are not competitors now could step in and eat our lunch tomorrow if they wanted to?

As another benchmarking tool, TAWPI just launched a survey to track error rates in remittance and retail lockbox operations. The results will be available by year’s end. Want to learn more? E-mail me at m_brousseau@msn.com.

Wednesday, October 3, 2007

PROFITSTARS™ ANNOUNCES THE ACQUISITION OF AUDIOTEL CORPORATION

Monett, MO – October 1, 2007 – ProfitStars (a division of Jack Henry & Associates, Inc. Nasdaq:JKHY) which provides highly specialized products and services that enable financial institutions to mitigate risks, optimize revenue, and contain costs, today announced the acquisition of Texas-based AudioTel Corporation. AudioTel supports more than 1,000 financial institutions with back-office and retail banking solutions. Terms of the transaction were not disclosed.

AudioTel provides proven remittance, merchant capture, check imaging, document imaging and management, and telephone and Internet banking solutions. The company has continually expanded its product offering and market presence since it was founded in 1993, and its specialized software and hardware solutions have consistently been on the forefront of the payment processing industry.

Jack Prim, CEO of Jack Henry & Associates, reported, “Our acquisition of AudioTel supports our strategy to acquire companies that provide additional complementary solutions we can cross sell to our core financial institution clients, that generate new cross-sale opportunities among our respective client bases, and that expand the specialized products and services our ProfitStars™ division sells to virtually any financial services organization regardless of core processing platform. We have identified synergies among our respective product lines, and we are particularly excited about the opportunity to enhance our enterprise payments offering with AudioTel’s thick/client remittance processing and lockbox solution, and to advance our 4|sight™ Check Imaging platform with AudioTel’s branch capture solution.”

According to Scott Doores, President of AudioTel Corporation, “We believe joining Profitstars and Jack Henry is in the best interest of our clients, our employees, and the future of our products and services. We expect access to Profitstars’ significant resources and technology tools will expedite our speed-to-market with ongoing functional enhancements. The opportunity to leverage its extensive support infrastructure will enable us to continually enhance our customer service initiatives. Joining Jack Henry will provide the stability only available as part of a public, financially sound company. And we are excited about our common corporate cultures, which are fundamentally focused on establishing long-term customer relationships by delivering quality products and outstanding service.”

“AudioTel marks Jack Henry & Associates’ 17th acquisition made to support our focused diversification strategy, which we adopted in 2004. We are especially excited about acquiring this company since it adds more products and services to our ProfitStars brand than any other focused diversification acquisition made to-date. In addition to enhancing ProfitStars’ market presence and potential, we expect this acquisition will have a slightly accretive impact on EPS for the remainder of our fiscal year 2008,” concluded Kevin Williams, CFO of Jack Henry & Associates.

Tuesday, October 2, 2007

SAP Launches Corporate-to-Bank Connectivity Service Offering for Banks

Service Package to Offer Banks Insight on Cost Savings and Value-added Services behind Standards-based Integration with Corporations

(From PRNewswire – Oct. 1, 2007)

SAP AG today announced a new service offering for banks to help them prepare for and take advantage of the latest technological advances in corporate-to-bank connectivity. The SAP consulting package outlines the benefits of standards-based, real-time corporate-to-bank connectivity in reducing costs and IT complexity while increasing wallet share and enhancing customer satisfaction. The announcement was made at Sibos, the world's premier financial services event, being held in Boston, October 1-5. The go-to-market service offering will be complementary to the SAP® Bank Relationship Management application and SAP Integration Package for SWIFT, a standardized software solution linking SAP ERP directly to SWIFTNet, the IP-based messaging platform connecting nearly 8,100 financials institutions in 208 countries and territories. The consulting package was developed to provide banks an educational resource to better leverage the potential of standards-based corporate-to-bank connectivity based on XML messages.

A recent study, "Are You a Strategic Thinker" conducted by financial news services Finextra and SAP found that over 86 percent of respondents who are responsible for payments are embracing the new XML message types. But of these respondents, 32 percent are only interested in using this standardization for interbank connections. Such a finding demonstrates the need for better understanding of utilizing XML messaging for corporate-to-bank connections. Today, banks and corporations maintain multiple payment channels and communication lines, often haphazardly integrated with ERP and transactions systems. This complexity increases business inefficiencies and security gaps and leads to higher support costs. With the SAP consulting package for bank connectivity, banks will be able to move away from proprietary applications to streamline payment cycles, consolidate security log-in points and improve compliance management. Additionally, specific value-added services can be delivered through the offering based on customer preferences. "With this additional service, banks will be able to enlarge their offering for their corporate customers," said Christian Kothe, head of SWIFT Central & Eastern Europe. "Unified corporate-to-bank connectivity will, over time, benefit both banks and corporations as the corporate offerings continue to evolve. This offering was a natural progression of the partnership SWIFT has with SAP." "With the evolution of standardized protocols and ERP applications, the opportunity now exists to create a fully contained corporate-to-bank ecosystem for all financial transactions," said Karl Kesselring, vice president OEM Sales & Partner Management, Global Banking Line of Business, SAP Labs, LLC. "Corporations have been the main protagonist in the popularity of corporate-to-bank connectivity, but banks have their own important role to play. Through the SAP consulting package for bank connectivity, our customers will get a better picture of what their vested interests are in this new framework and will give them the proper tools to build the framework from their end."

Setting Trade Show Expectations

Go to any trade show – big, small, crowded or sparsely attended – and you’re sure to hear some vendors grousing about how lousy it was. Quite often, the problem isn’t the trade show; it’s the lack of objectives and expectations that the grumbling exhibitors set for the show.

Many exhibitors try to determine their expectations for trade show expenditures after the fact. These same companies would never dream of embarking on a product development initiative without setting clear objectives, so why in the world would they spend considerable time and money on a trade show without doing the same?

What companies need to do is define clear objectives and expectations before ever placing a deposit on their booth space. These objectives might include generating a specific number of leads, building corporate visibility, meeting potential partners, coddling key customers, providing so many product demonstrations, or creating buzz about a concept.

With these objectives in place, exhibitors avoid the sliding scale of expectations that typically leads to disappointment (and uncomfortable conversations with the senior management who sign off on the expenditures). These objectives also enable exhibitors maximize their expenditures by helping ensure that they don’t buy too much (or too little) booth space, bring too many people (or the wrong people), print the wrong product collateral (or too much), have a needless or inappropriate booth giveaway (more on this another day), or create the wrong product demonstrations or booth signage. Want to know more? E-mail me at m_brousseau@msn.com.

Sunday, September 30, 2007

Mobile Devices: New Payments Tool

New analysis from Frost & Sullivan finds that the number of users of mobile banking services in the United States could reach 21.27 million in 2010.

“Mobile devices are becoming important tools in the payments and banking space and can definitely be expected to play an important role in the U.S.,” said Frost & Sullivan Strategic Industry Analyst Vikrant Gandhi. “There is a flurry of recent activity around both payments and banking, with investments, operator adoption and development of innovative solutions driving these markets.”

Various mobile payment solutions allow peer-to-peer (P2P) money transfer between individuals through the mobile phone, while increasing penetration of mobile data services such as messaging, mobile Internet and others offer multiple avenues for providing mobile banking services.

However, gaining subscribers’ confidence and educating them about the capabilities of mobile financial services offerings poses a major challenge, Gandhi said. There are bound to be concerns about storing subscriber information on the handset or losing connectivity in the middle of an important financial transaction.

“A strong push by FIs and mobile operators is required to help in the adoption of mobile financial services,” said Gandhi. “Specialized industry participants from the mobile payments and mobile banking segments need to work closely to offer solutions capable of satisfying a wide range of financial needs of mobile subscribers.”

The key success factor will lie in giving customers the option of performing various financial transactions on the move, Gandhi predicted. While mobile payments and banking may never fully replace online interactions, they could prove to be an ideal fit for particular types of transactions such as micro-transactions. These services can also be tailored to the needs of a particular niche or category of customers by adjusting various parameters.

Integrated mobile banking and payments services are likely to be a key future trend, according to Frost & Sullivan's research. Where is your financial institution in the rollout of its mobile payments and banking offerings? E-mail me at m_brousseau@msn.com.

Structured Docs Going Image

Despite all the industry talk about automating unstructured document processing – and it’s sure to be a hot topic at TAWPI’s Capture Conference in December – to date, most organizations have focused their imaging efforts on structured documents. According to a recent Question of the Week on the TAWPI Web site, 80 percent of respondents said they imaged “mostly structured documents,” while 11 percent of respondents said they imaged “mostly unstructured docs.” Nine percent of the 87 respondents to the question said their organizations imaged “mostly semi-structured documents.” Where is your organization putting its efforts? E-mail me at m_brousseau@msn.com.

Friday, September 28, 2007

Remote Deposit Capture Delivers

A whopping 78 percent of respondents to a recent TAWPI Question of the Week say that their organization is receiving payback on its remote deposit capture deployment. Only 6 percent of the 86 respondents said they weren't receiving payback, while 16 percent said they didn't know. How is your organization faring with remote deposit capture? E-mail me at m_brousseau@msn.com.

Could BOC Outpace ARC?

Back Office Conversion (BOC) has gotten off to a surprisingly slow start since becoming effective earlier this year. Yet respondents to a recent TAWPI Question of the Week were split nearly down the middle on the issue of whether BOC’s growth rate could eclipse that of Accounts Receivable Check (ARC) Conversion. Forty-five percent of the 232 respondents said BOC will outpace ARC, while 44 percent disagreed. Eleven percent of respondents to the question said they didn’t know. Has your organization changed its thinking on BOC? E-mail me at m_brousseau@msn.com.

Thursday, September 20, 2007

Outsourcing Looms Large

The push towards remittance outsourcing may get a second wind, according to the results of a recent Question of the Week on the TAWPI Web site. A whopping 58 percent of the 264 respondents to the question are planning to outsource their remittance operations, and another 13 percent of respondents are unsure of their plans – meaning, up to 71 percent of remittance operations could be outsourced. Only 29 percent of respondents said they were committed to their in-house operations.

The growing interest among corporate billers in outsourcing their remittance operations doesn’t surprise Steve McNair, president of FTP Consulting Services, Inc., in Southlake, TX (mcnairs1@aol.com), but he admits that the survey’s findings are “extremely significant.”

“The problem is that remittance solutions vendors have stuck with an outdated financial model, and there simply aren’t enough productivity gains and cost savings in the technology to pay for the systems,” McNair said. “It’s been seven years since most remittance processors last implemented new systems. But when processors look at the cost new technology, three things give them pause: concern that they won’t get enough bang for their technology buck, declining check volumes, and long payback times. Vendors need to find an alternative way for corporate billers to implement new technology that doesn’t require a significant upfront capital investment.”

McNair noted that two prominent companies engaged him in the past year to help evaluate the feasibility of implementing new technology platforms. Both companies ultimately determined that better technology platforms were available, but neither one could cost-justify the move. For the time being, they are sticking with the status quo. Has your organization had a similar experience? E-mail me at m_brousseau@msn.com.

Wednesday, September 19, 2007

SLAs Hardly MIA

Service Level Agreements (SLAs) have become the norm, according to the results of a recent Question of the Week on the TAWPI Web site. A whopping 97 percent of respondents have SLAs in place with their providers or their customers (depending on which side of the processing equation they are on), while just three percent of respondents still do business without SLAs. Any tips for effective SLAs? E-mail me at m_brousseau@msn.com.

Can Your Data-Entry Operators Keep Up?

Ever wondered how your data entry operators stack up against those at other operations? The results of a recent Question of the Week on the TAWPI Web site might give you some insight. Sixty-eight percent of respondents said their data-entry operators average between 5,000 and 10,000 keystrokes per hour, while 25 percent of respondents said their operators average between 10,000 and 15,000 keystrokes per hour. Five percent of respondents have super-fast operators who average more than 15,000 keystrokes per hour, while just 2 percent of respondents said their operators average fewer than 5,000 keystrokes per hour. So, what does your organization expect of its data-entry operators? E-mail me at m_brousseau@msn.com.

Want to be Remembered?

Attention vendors: If you want to make your exhibit booth more memorable, focus on the steak, not the sizzle. According to Exhibit Surveys Inc.’s annual Most-Remembered Exhibits study, 68.1 percent of respondents attributed their memories of the top 22 exhibits of 2006 to “product interest” followed by “company name” (54.8 percent) and “product demo” (51.2 percent). Promotional giveaways – which swayed only 13.9 percent of respondents – was the least important factor to which respondents attributed their memories of top exhibit booths.

So before you buy those cases of light-up bouncing balls, remember that recognizable company names, buzz-worthy new products and engaging presentations are traits that put exhibits permanently on attendees' minds. What exhibit booths did you think were most memorable at this year's TAWPI Forums & Expo in Boston? E-mail me at m_brousseau@msn.com.

Wednesday, August 29, 2007

Revolutionary Convergence Highlighted at Forums & Expo

By Dan Bolita, ICP

In a demonstration of the convergence of transaction processing

technologies, the TAWPI 2007 Forums & Expo in Boston highlighted

the growing demand for industry information, education and solutions. Attracting a robust 20 percent increase in attendance and a highly knowledgeable attendee base, the three day conference delivered lively education sessions, round table discussions

and networking opportunities. TAWPI billed its 2007 Forums & Expo as revolutionary and took a number of steps to diversify the content, attract new exhibitors and increase attendance. The results of these steps were

impressive:

• The numbers of full forum registrations for this year’s event were

up 20 percent compared to last year – placing them at the highest

level in five years—and the number of companies in this

year’s expo hall was up over 10 percent.

• Approximately 25 percent of this year’s full-forum registrants

were new to TAWPI, demonstrating the interest in transactional

process content.

• The demographic mix of this year’s full-forum attendees showed

a higher representation of senior management and treasury management

professionals.

“TAWPI is extremely excited about the opportunities that lie

ahead,” said TAWPI President Frank Moran. “We recognize the

convergence of these technologies, yet our attendees were given

three separate forums each with specialized content—that formula

worked well.”

In an increased effort to facilitate industry-specific peer-to-peer

interaction, the Forums offered a number of vertically focused

round-table and networking events. Facilitated by a moderator,

these were some of the most compelling interactions, as professionals

met face-to-face. Payment processors from governmental taxing authorities and state departments of revenue shared candid experiences with process automation. Similarly, in healthcare transaction processing, insurance, banking and utility discussions,

attendees were able to share their experiences in an open and vendor-neutral environment.

A number of times, these discussions were able to offer specific tips or advice that processors could apply to their own operations. A recurring sentiment was the disconnect between promised expectations of benefit and actual results. Nonetheless, most operations professionals agreed that rewards from the deployment of current technology far outweigh the risk of waiting.

Keynote Presentations

In a well attended and entertaining presentation, James Cunha, Senior VP of the Federal Reserve Bank of Boston made a humorous,

yet highly relevant analogy between the changing nature of payments and the historical changes in refrigeration. Comparing check processing to the robust demand for ice in the mid nineteenth century—and the sudden decline in ice-harvesting—Cunha found many parallels. In the 1800s, ice harvesting was the largest non-agricultural industry. However, due to the advent of mechanical refrigeration, the industry was fundamentally changed. Similarly, the development of alternate payment methods has dramatically impacted paper check processes. Cunha noted that the demand for the cooling power brought by ice never went away, similarly the ability to pay obligations has not diminished despite the fact that using checks for the purpose is in steep decline. Cunha effectively drove home the point that industries in transition offer remarkable opportunities, sometimes not recognized until years later. Continuing the analogy, he noted the new opportunities of fresh foods brought by at-home refrigeration, as well as the development of air conditioning.

In the payments space, the decline of paper checks has brought a range of technology opportunities including multiple payment choices, faster access to funds, and a hastened deployment of

image-based tools.

In a separate address by US Postal Service Deputy Postmaster General Patrick Donahoe, attendees heard of the renewed emphasis that the US Postal Service has placed on its remittance business. Donahoe also noted the decline in paper volume, outlining steps the USPS is taking to offset a decline in remittance postage revenue.

By all counts, the TAWPI 2007 Forums was a measurable success. The exhibit floor remained active throughout the three days, and sessions were well-attended right up to the closing session. Perhaps the best indicator is the fact that nearly all of the

exhibitors have already reserved their spots for the TAWPI 2008 Annual Forums scheduled for August 24 - 27th, in Orlando, Florida.

Monday, August 27, 2007

Warning to Vendors: Your Customers are Getting Smarter

Of the many things that impressed me at the recent TAWPI Forums & Expo in Boston—and there were many: the quality of the speakers; the cohesive nature of the solutions; the networking opportunities; the performance of the Red Sox—what was perhaps most noticeable was the sophistication of the Forum attendees. Long-time TAWPI

members, and a marked increase in fresh faces demonstrated a keen awareness of the industry, the business problems they faced, and the historic shortcomings of some of the available solutions. By and large, our members are getting smarter. While this is a good sign for TAWPI, and is in some small measure a testimony to the value of the education the Association provides, it poses challenges to the vendor community. An educated constituency asks tough questions, demands more mature solutions, and expects more from its suppliers.

The knowledge our members have gained has not come cheaply. While the cost to attend TAWPI’s annual forum, the regional conferences or Web events is a relative bargain, it’s the price paid investing in solutions that weren't a good fit, weren't ready for prime time, or just didn’t work, that has cost the most. “Learning the hard way” may not be the best lesson, but these are the lessons not soon forgotten. These sadder-but-wiser constituents now demand tangible demonstrations of a solution’s effectiveness. Not only do data extraction tools need to work in the demo booth with perfectly prepared samples, they need to work in production using real world forms. The advantages of Remote Deposit Capture are many, but woe to the vendor that neglects to address such issues as training, maintenance and customer service. Today’s customers understand scalability, reliability and usability. They are asking about regulatory compliance, document retention, image quality and total cost of ownership. They expect their suppliers to not only understand the technology, but its appropriateness for the specific application or industry where it will be applied. In the industry roundtable discussions (a new, and highly successful feature at this year’s Forums) as well as in interactions on the Expo floor, the attendees were savvy about the technology, understood the terminology, and were more interested in how solutions would fit with their existing business process than they were with bells or whistles. And to our vendors’ credit, they seemed to welcome the challenge. Having successfully survived the mergers, acquisitions, and technology changes of the past several years,

the solution providers on display in Boston were likewise well-informed, candid and eager to show how far the industry has come. While there may always be a disconnect between the promise of technology and the

need it’s intended to fulfill, that gap is closing–in no small part thanks to the demands of an informed market.

Dan Bolita, ICP

TODAY Editor

Wednesday, August 8, 2007

CEO View: Distributed Capture Trends, Opportunities and Threats

TAWPI Theatre, Exhibit Hall, Second Level, Hynes Convention Center, Boston

Panelists: Danne Buchanan, CEO, NetDeposit

Brian Geisel, President, Alogent

Bala Balasubramanian, President & CEO, J & B Software

additional panelists to be announced

Moderator: Doug Hartsema, Senior Vice President, JPMorgan Chase

This interactive panel discussion features insight and advice from prominent solutions providers. During the session, attendees will gain a better understanding of the latest technologies and strategies for distributed capture, payments automation and receivables management. The main focus of the discussion will be to detail the most important technologies shaping the capture market and the key trends and innovations that are changing the way information is captured, processed, managed and delivered.

Thursday, August 2, 2007

Fiserv to Aquire Checkfree

“By joining our complementary technology and capabilities with Fiserv and its unparalleled footprint, this new combined entity will broaden Fiserv’s offerings to customers worldwide,” said Pete Kight, CheckFree Chairman and Chief Executive Officer. “In particular, it will significantly accelerate the delivery of next-generation services to financial institutions and their customers. CheckFree’s broad range of offerings will also enable Fiserv to round out its ability to deliver solutions that address the challenges of an evolving U.S. payments landscape and help facilitate the growth of the managed accounts industry.” In conjunction with the closing of the transaction, Kight will be employed by Fiserv and appointed to its board of directors.

“Pete’s demonstrated results in building one of the world’s leading payment and transaction

processing companies are a testament to his energy, vision and strategic leadership,” said Donald F. Dillon, Fiserv Chairman. “We will be thrilled to have him on our board.”

Fiserv expects to realize more than $100 million in annualized cost savings and more than $125 million in annualized revenue synergies. For 2008, the transaction is expected to be accretive to Fiserv’s underlying cash earnings per share.

The transaction is expected to be completed by December 31, 2007, subject to regulatory approvals, approval by the CheckFree shareholders and customary closing conditions. After closing, the combined company will have pro-forma revenue of about $6 billion, employ more than 27,000 associates world-wide and be the leading provider of technology processing solutions to banks and financial institutions. “We are impressed by the people of CheckFree. Their cultural commitment to clients is consistent with how we do business and this combination will create significant growth opportunities for all of our people,” said Yabuki.

Tuesday, July 24, 2007

J&B Software will demonstrate the new Cheq-IT Vermezzo System at the 2007 TAWPI Conference

Cheq Information Technology Inc. today announced that following the successful integration of the Cheq-IT Vermezzo System into their NDM Remote Capture Solution, J&B Software will be demonstrating their solution at the Annual TAWPI 2007 Convention. Jim Wynn, Director of Marketing for J&B Software commented, “This new capture device is a ‘must see’ for those organizations who are looking to combine pages, checks, coupons and source documents in a single pass. By combining the attributes of this new scanner with our NDM Remote Capture solution, users will be able to measure for themselves the process improvements and benefits that we can now provide.” According to Tom Benedetto, J&B Software’s Director of Industry Solutions, “We had recognized for some time the need for a system that could capture full page and check size documents in a single pass would be of considerable benefit to our corporate clients. Now that we have done our first integration, we are quickly learning that this system opens the way to further automate image processing across a broad spectrum of applications. For example, we can now further automate our client’s branch locations and ‘image capture’ many different paper based applications that are still performed there.” He went on to say, “With the advent of Check 21 clearing, there is now no limitation on regional or nationwide corporate remittance capture being channeled to a central corporate treasury cash management system.” John V. Ashley, CEO of Cheq Information Technology Inc. the supplier of the Cheq-IT Vermezzo System concluded by saying “J&B Software share our vision for the commercial use of the Vermezzo System and it is very gratifying for us to work with such a talented company who are pressing the envelope of change to the benefit of their clients.”

Monday, July 23, 2007

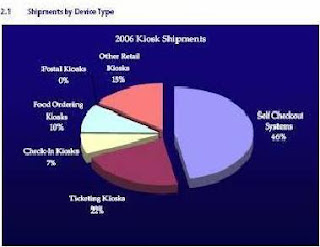

Consumers on track to spend $1.3 trillion a year at self-service machines by 2011

From IHL: When it comes to paying for goods & services, consumers continue to take matters into their own hands. North American consumers are on pace to spend $525b at self-checkout lanes, ticketing kiosks & other self-service machines in 2007, an increase from $438b in 2006. ‘The revenue generated by self-service transactions should continue this pace of growth in the coming years,’ said Greg Buzek, IHL. ‘We expect that expenditures made at self-service kiosks will rise by 20% this year & 18% in 2008. Demand for self-checkout systems & other kiosks should push the dollar value of transactions to $1.3 trillion by 2011. Consumers enjoy self-service & increasingly seek out retailers that offer the technology. Retailers & other businesses are finding that self-service kiosks can increase customer loyalty, & customer satisfaction.’ In the market study, 2007 North American Self-Service Kiosks, IHL examines the increasing use of 4 types of self-service kiosks where payment is accepted: self-checkout systems, ticketing kiosks, check-in kiosks, food ordering, & postal kiosks. The report covers self-service kiosks in US & Canada, detailing the number & type of kiosks shipped historically. It provides forecasts for each type of kiosk, in terms of units shipped & revenue transacted. The report highlights best practices & best-in-class machines for each kiosk class.

Wednesday, July 18, 2007

TAWPI 2007 Forums and Expo Partners with the Indo American Chamber of Commerce

TAWPI has announced a strategic partnership with the Indo-American Chambers of Commerce (IACC) for this years 2007 Forums and Expo this August 12th to 15th in Boston Massachusetts.

The IACC is focused on promoting trade, highlighting international business opportunities, and acting as a catalyst for developing economic growth between India and the United States.

“Having the international support of the IACC and bringing their members and technology buyers to Boston for the TAWPI event this summer is something we are extremely excited about.” “With the explosive growth overseas in payments and the data capture industries, the TAWPI event is a perfect match for their members to network and learn about new business applications,” said Frank Moran President TAWPI.

The TAWPI 2007 Forums and Expo is renowned for bringing together end-user professionals who share ideas and concepts openly and thoroughly for mutual understanding and knowledge. This event is specifically designed for senior level information technology executives looking for information on how to manage, streamline and optimize their information capture processes.

“We are happy to offer our IACC members who are involved in information capture the benefit to attend the TAWPI Forums and Expo.” “This will provide our members the opportunity to network with end-users from the United States and also bring back certain technologies and best practices to India for our own operations,” said Shabina Patel -Regional Director.

About IACC: The IACC is focused on promoting trade, highlighting international business opportunities, and acting as a catalyst for developing economic growth between India and the US. Discover significant business opportunities, read opinions of the experts and find practically everything to do with Indo-US Business on our website. Also available special benefits by becoming an IACC member - like free publications and up to date information at all times. Membership to the Indo-American Chamber of Commerce is something everybody connected with Indo-US business, trade or relations looks forward to. IACC has more than 2,600 members-representing small, medium and large enterprises, both Indian and American. Web: www.iaccindia.com

About TAWPI: TAWPI is a Membership Association dedicated to helping practitioners in the payments automation, distributed capture, and imaging & forms processing arenas maximize their value as professionals, enhance operations efficiency and effectiveness, and position their organizations for success in the future. For more information, visit www.tawpi.org.

Friday, July 13, 2007

VeriFone Announces Agreement for In-Taxi Acceptance of Credit Cards with New York’s Largest Taxi Leasing Association

Now we're talking. There is nothing worse than burning cash on a business trip or vacation for taxi's.

from The Greensheet – July 12, 2007)VeriFone Holdings, Inc. announced today an agreement to be the preferred vendor of integrated payment solutions to the largest licensed taxi leasing association in New York City, the Committee for Taxi Safety with 3,000 member taxis. VeriFone also announced that more than 5,000 New York City taxis are signed or committed to comprehensive multi-year agreements for in-taxi acceptance of credit cards. Last month, systems implemented by VeriFone's US-based taxi business, VeriFone Transportation Systems, were the first authorized by the NYC Taxi and Limousine Commission (TLC) for the city's more than 13,000 taxis. Jeff Dumbrell, VeriFone senior vice president, North America, said, "New York City currently has over 13,000 active yellow cabs that have been mandated to provide card payment and passenger information services by the end of the year. We are continuing our sales campaign and expect to make further progress in the months ahead."

Committee for Taxi Safety Agreement

Thursday, June 28, 2007